Thông tin liên hệ

![]() Hồ sơ ứng viên có số điện thoại, email và bao gồm 1 cv đính kèm.

Hồ sơ ứng viên có số điện thoại, email và bao gồm 1 cv đính kèm.

| Thống kê kết quả liên hệ của các nhà tuyển dụng | Số lượt | Thời gian liên hệ gần nhất |

|---|---|---|

| Liên hệ thành công | 0 | Chưa có |

| Liên hệ không thành công | 0 | Chưa có |

Trên 20 năm

Trưởng bộ phận/ Trưởng phòng

Thỏa thuận

HCMC

Tiếng Anh (Khá)

5 sao

Tài chính, kế toán

Giới thiệu bản thân

Trình độ học vấn chuyên môn

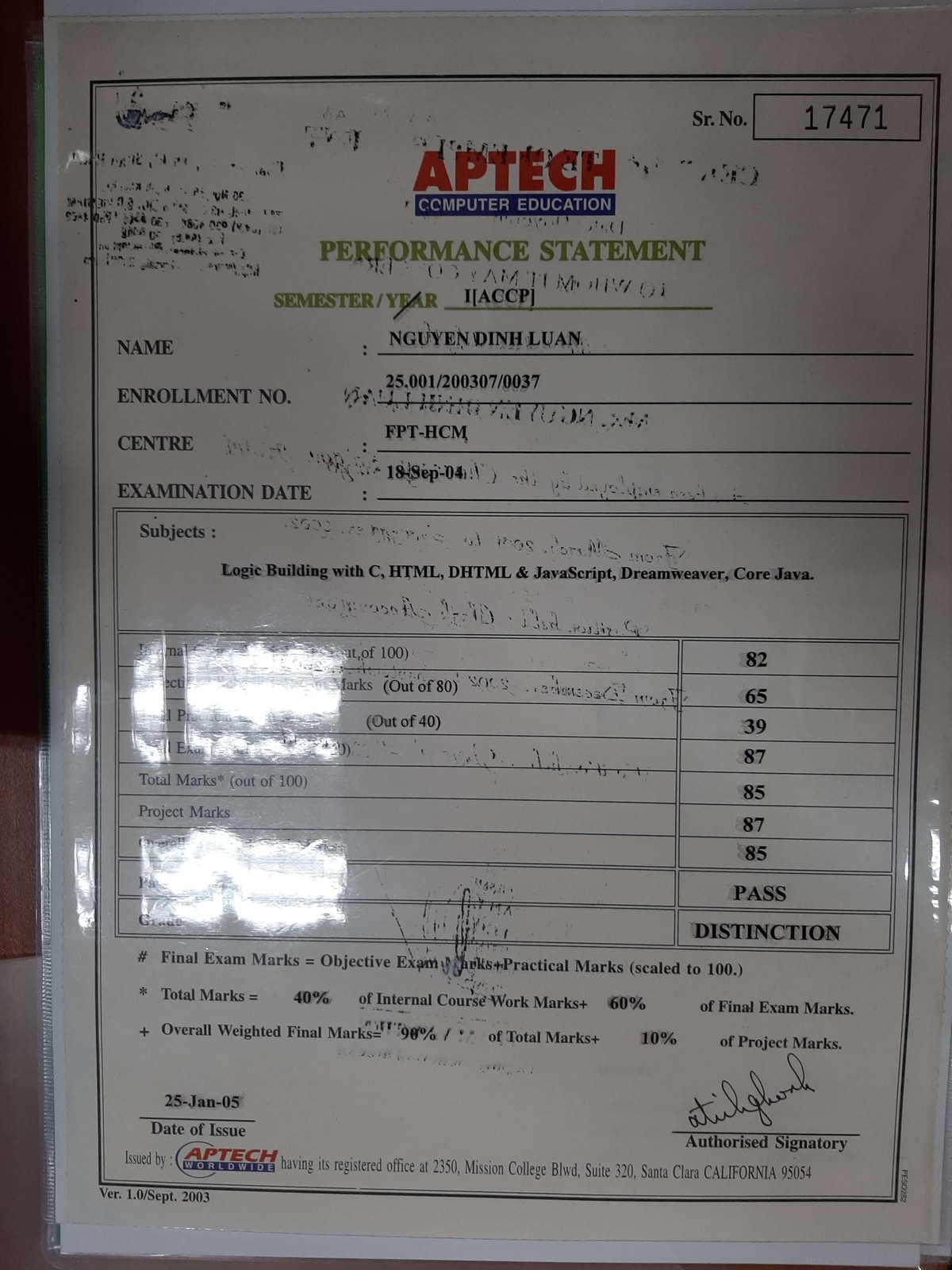

FPT Aptech Ho Chi Minh City

Information System Management Technology - Khác

2003 → 2004

Degree of Information System Management Technology

Economic University of Ho Chi Minh

Accounting & Auditing - Đại học

1996 → 2000

Kĩ năng

| Accounting system setup | |

| Annual budget preparation | |

| Internal controls | |

| Monthly financial statements | |

| Audit support | |

| Compliance requirements | |

| Data conversion | |

| Excel (advanced level) | |

| Data integrity | |

| Tax declaration, tax finalization, tax inspection, tax returned | |

| Micros Opera | |

| Infor HMS | |

| VBA Programming | |

| PHP CodeIgniter Web Dev | |

| Sun System Accounting V4 |

Kinh nghiệm làm việc

Chief Accountant tại Sotetsu Grand Fresa Saigon

5/2022 → 6/2023 (1 năm 1 tháng)

Ho Chi Minh City

• Strongly supports to HR & Admin Manager for recruitments, labor contracts, social insurance, procurements… for whole of pre-opening period. • Set up and progressed accounting structures and processes to meet commercial enterprise needs and maximize effectiveness of operations (included accounting software setup, e-invoice system setup...) • Contribution to successful setup for the configuration of Infor HMS system. • Make advisory to General Director the ways to prevent tax risks, helpful supports to him for company’s financial decisions. • Contracts review for win-win to parties & prevention for potential risks. • Make accounting SOPs & job assignments for accounting staffs to make sure cross check & well controlled.

Chief Accountant (Aug 2017 – May 2022) | General Accountant (Apr 2017 – Aug 2017) | Senior Accountant (Jun 2011 – Apr 2017) tại Sherwood Residence

6/2011 → 5/2022 (10 năm 10 tháng)

Ho Chi Minh City, Vietnam

Chief Accountant: Monthly P&L presentation Make internal management reports requested by BOM & head quarter. Make statistic reports to local government. Financial analytic on P&L statement. Make yearly budget, rolling quarterly forecast & budget implementation & control. Suggestions to BOM for smoothly business operations in the references with updated laws (tax law, business law, civil law, labor law, social insurance law…) Monitoring cash payments to ensure these was followed up strictly to company’s SOP, correct amount & on time Check wire bank transfer before verification on VCB money software to make sure everything is correct and follow up strictly company’s SOP. Check strictly deposit refund request in deep references to leasing contact terms such as early termination, currencies in refund, deduct deposits to room charges in the strictly following up by civil law. Check carefully leasing contracts to determine terms & conditions on deposit, payment, price, tenant benefit… try to win the best conditions to the company. Check carefully purchasing goods & services contracts on the conditions of price, warranty, payment period to make sure everything is legal, reasonable and accordingly to company’s policies. Check carefully commission for agent contracts to make sure the payable amount must be fair with the staying period & accommodation room charges as well as tenant’s benefits. Calculation & monitoring sale commission to prevent mistake, double claims and strictly according to sale incentative commission policies. Make accounting SOP & job assignment for accounting staffs to make sure cross check & well controlled. Monthly training plan on Vietnamese Accounting Standards, tax invoices related matters, tax laws... to accounting staffs. Research & improvement methods for more effective accounting’s operation by daily update on law knowledge, developed VBA programming code on Excel & Access to support accounting team & internal control matters. Resolve staff’s conflicts. General Accountant: Voucher control by separated complimentary voucher & sale voucher and by serial number & expired date. Verify monthly input VAT, output VAT before submit to head quarter. Make monthly personal income tax, withholding tax. Check payroll & make employee benefit, employee meal calculation. Check the refund from social insurance for sick leave, pregnant leave, health allowances… Accrual & provision for social insurance, health insurance, unemployment insurance, electricity, water, telephone expense to make sure these will be followed strictly to government laws & company’s rules. Make all the expense transactions related to goods purchased directly, purchased services. Fixed asset & depreciation to accounting laws & tax laws. Prepayments & deferred charged calculation and allocation to make sure these are reasonable and matched to accounting laws. Make monthly P&L statement. Check the food & beverage cost board prepared by Cost Controller in comparison between Procure system & P&L statement to make sure no variance. In charge of internal receivable & payable related to other branches & head quarter. Submit all general ledgers, trial balance, balance sheet to head quarter. Read & research tax laws, accounting laws, circulars, tax letters… issued by government and train to other accounting staffs every weekend. Work with external auditor on yearly audit. Support AR & AP in their reconciliation balances.

Mong muốn về công việc

Giải thưởng

Employee of the month

1/2015

Passion for people award at Sherwood Residence

Kho tài liệu

Kho tài liệu  Chuyên trang đào tạo

Chuyên trang đào tạo

Việc làm thêm

Việc làm thêm

1189 Lượt xem hồ sơ

1189 Lượt xem hồ sơ

Google

Google Facebook

Facebook Zalo

Zalo