Thông tin liên hệ

![]() Hồ sơ ứng viên có số điện thoại, email và bao gồm 1 cv đính kèm.

Hồ sơ ứng viên có số điện thoại, email và bao gồm 1 cv đính kèm.

| Thống kê kết quả liên hệ của các nhà tuyển dụng | Số lượt | Thời gian liên hệ gần nhất |

|---|---|---|

| Liên hệ thành công | 0 | Chưa có |

| Liên hệ không thành công | 0 | Chưa có |

Từ 5 đến 10 năm

Giám sát

20 - 30 triệu

Đồng Nai

Tiếng Anh (Giỏi)

1.000 - 4.999

Tài chính, kế toán

Khác

Giới thiệu bản thân

Trình độ học vấn chuyên môn

University of Economics Ho Chi Minh City

Certificate of Customs Importing/ Exporting Essentials - Result: Very good. - Khác

2022 → 2022

University of Economics Ho Chi Minh City

Certificate of TAX Declaration - Result: Very good. - Khác

2022 → 2022

Ho Chi Minh City University of Law

Skill in negotiating, drafting and resolving disputes arising from contracts. - Khác

2021 → 2021

The University of Science

Programming Excel and Programming SQL - Khác

2018 → 2018

Programming Excel - Score: 9. Programming SQL - Score: 8.

University of Economics Ho Chi Minh City

Certificate of Chief Accountant Training - Result: Good. - Khác

2018 → 2018

The University of Science

MS. Excel - Khác

2010 → 2014

- MS. Excel for Accounting, level B - Score: 10 - Mastering Office Tools, level B - Score: 8.5

IIG Viet Nam

TOEIC 655. - Khác

2014 → 2014

The University of Finance Marketing

Business Accounting - Đại học

2010 → 2014

Kĩ năng

| Dashboard, Making financial statement, Excellent in excel, legal knowledge, Analytical skills, Critical thinking, Problem-solving and time management skills |

Kinh nghiệm làm việc

GENERAL ACCOUNTANT tại Lam Tai Chanh Petroleum Trading Company

1/2015 → 6/2016 (1 năm 5 tháng)

Ho Chi Minh City

GENERAL ACCOUNTANT – Lam Tai Chanh Petroleum Trading Company Ho Chi Minh City. - Create VAT invoices, payment vouchers, and receipt vouchers. - Check and record bank documents, expenses, and revenue. - Make VAT declaration and environmental protection tax monthly. - Make the using invoices quarterly and the statistic report monthly. - Check stock summary monthly. - Make the loan application and use loan inspection record. - Make final accounting entries. - Check the balance between detailed and general books. - Synthesize and count sales, expenses, and goods as required. - Make financial statements.

ACCOUNTANT tại ESSONS Global Industrial Company Limited

8/2016 → 2/2017 (6 tháng)

Bien Hoa City, Dong Nai

- Create VAT invoices. - Record and track export and domestic revenue. - Make payments for foreign debt. - Record and pay wages and import tax. - Make banking transactions. - Create the cash flow forecasting. - Make reports of revenue and receivables.

COST ACCOUNTANT tại May Viet Company Limited

3/2017 → 6/2019 (2 năm 3 tháng)

Bien Hoa City, Dong Nai

- Record export revenue, purchases, and expenses. - Check, process, and record bills of materials for all factories. - Record inbound and outbound transactions of materials, semi- finished goods, and finished goods. - Check stock summary monthly. - Collect and allocate the manufacturing overhead costs and direct labor costs. - Calculate and check product costs. - Create an Excel file to track, check, and control the purchase orders based on bills of materials.

ACCOUNTANT tại Scavi Joint Stock Company

7/2019 → Hiện tại

Bien Hoa City, Dong Nai

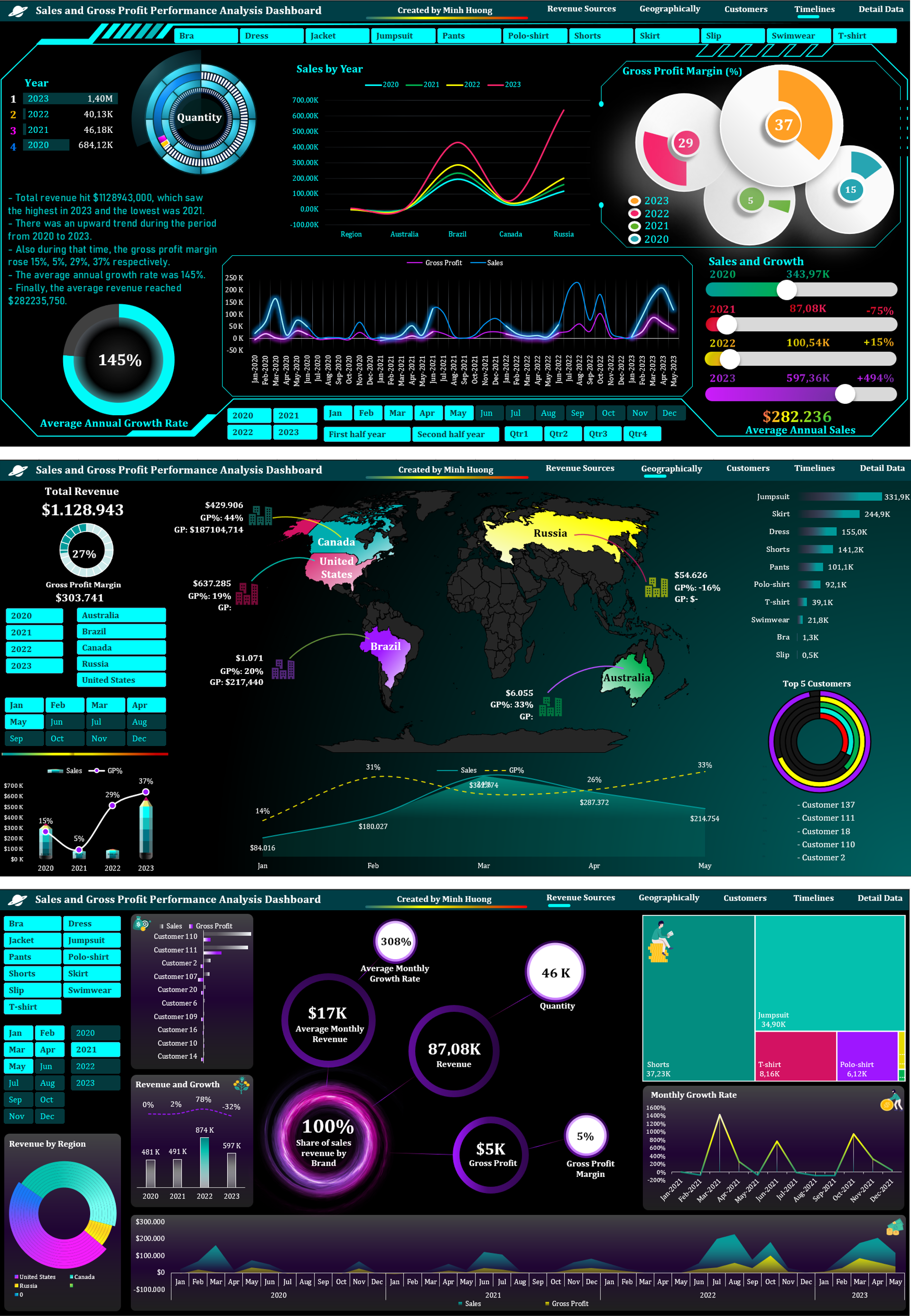

- Analyze sales fluctuations, and gross profit margin, calculate average growth rate by - customer, product, and region, and analyze receivables by debt age monthly, quarterly, and yearly visually using Dashboard for CEO, CFO. - Standardize the process of issuing domestic and export VAT invoices according to Tax law, Accounting Standards, and Customs. - Summarize, track, and control L/C risks from foreign customers. - Track and push foreign customers’ debts via email and meetings. - Warn the overdue receivables or exceeding insurance limits. - Track, compile, and record the provision for bad debts and write off bad debts. - Support and advise on checking and controlling the legality of purchase invoices. - Record and compare the accounts receivable and revenue books. - Control domestic sales prices, calculate gross profit and profit margin of sales orders for - CEO. - Ensure the recording and deducting of sales in accordance with tax regulations and accounting standards. - Collect and allocate the manufacturing overhead costs and direct labor costs. - Calculate and check product costs. - Make united transaction reports for the Customs and Tax Agency. - Update and popularize the latest regulations on invoices, documents to relevant departments. And propose plans to comply with regulations.

Mong muốn về công việc

Giải thưởng

The Excel Challenge Competition

1/2017

The second prize of the Excel Challenge Competition at ESSONS Global Industrial Company Limited.

Kho tài liệu

Kho tài liệu  Chuyên trang đào tạo

Chuyên trang đào tạo

Việc làm thêm

Việc làm thêm

205 Lượt xem hồ sơ

205 Lượt xem hồ sơ

Google

Google Facebook

Facebook Zalo

Zalo