Thông tin liên hệ

![]() Hồ sơ ứng viên có số điện thoại, email và bao gồm 2 cv đính kèm.

Hồ sơ ứng viên có số điện thoại, email và bao gồm 2 cv đính kèm.

| Thống kê kết quả liên hệ của các nhà tuyển dụng | Số lượt | Thời gian liên hệ gần nhất |

|---|---|---|

| Liên hệ thành công | 0 | Chưa có |

| Liên hệ không thành công | 0 | Chưa có |

Từ 10 đến 20 năm

Nhân viên

Thỏa thuận

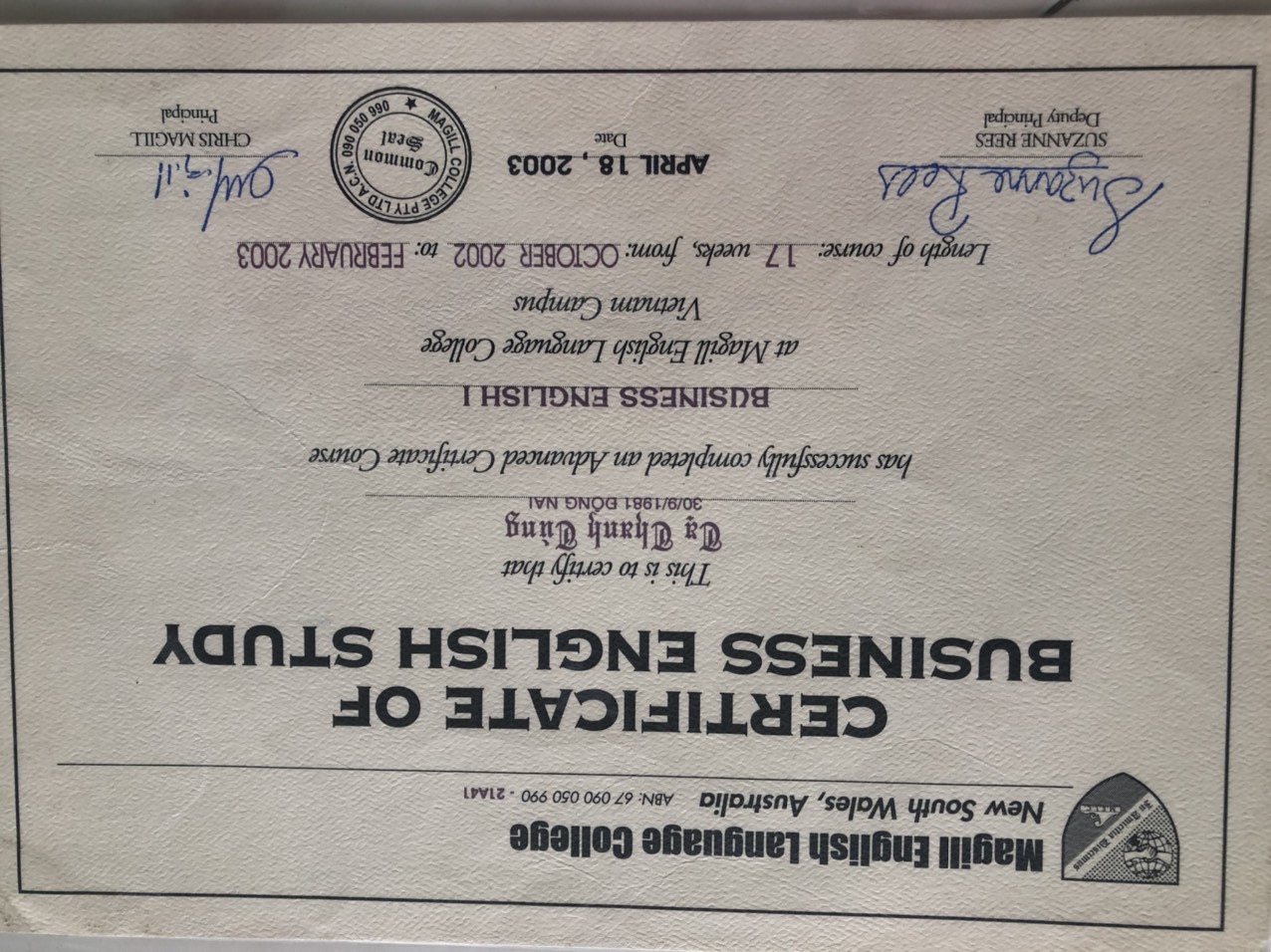

Tiếng Anh (Khá)

1.000 - 4.999

Giới thiệu bản thân

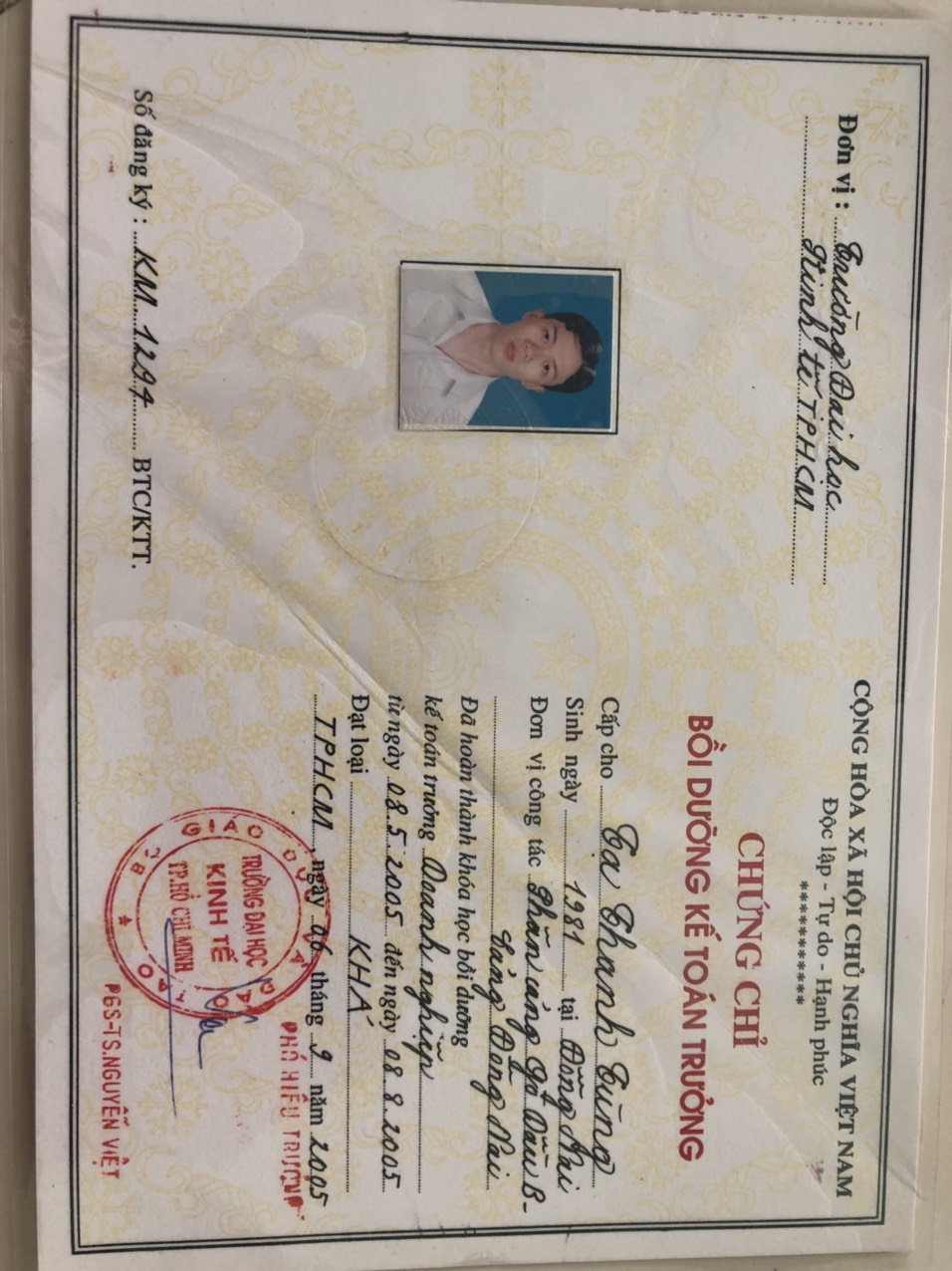

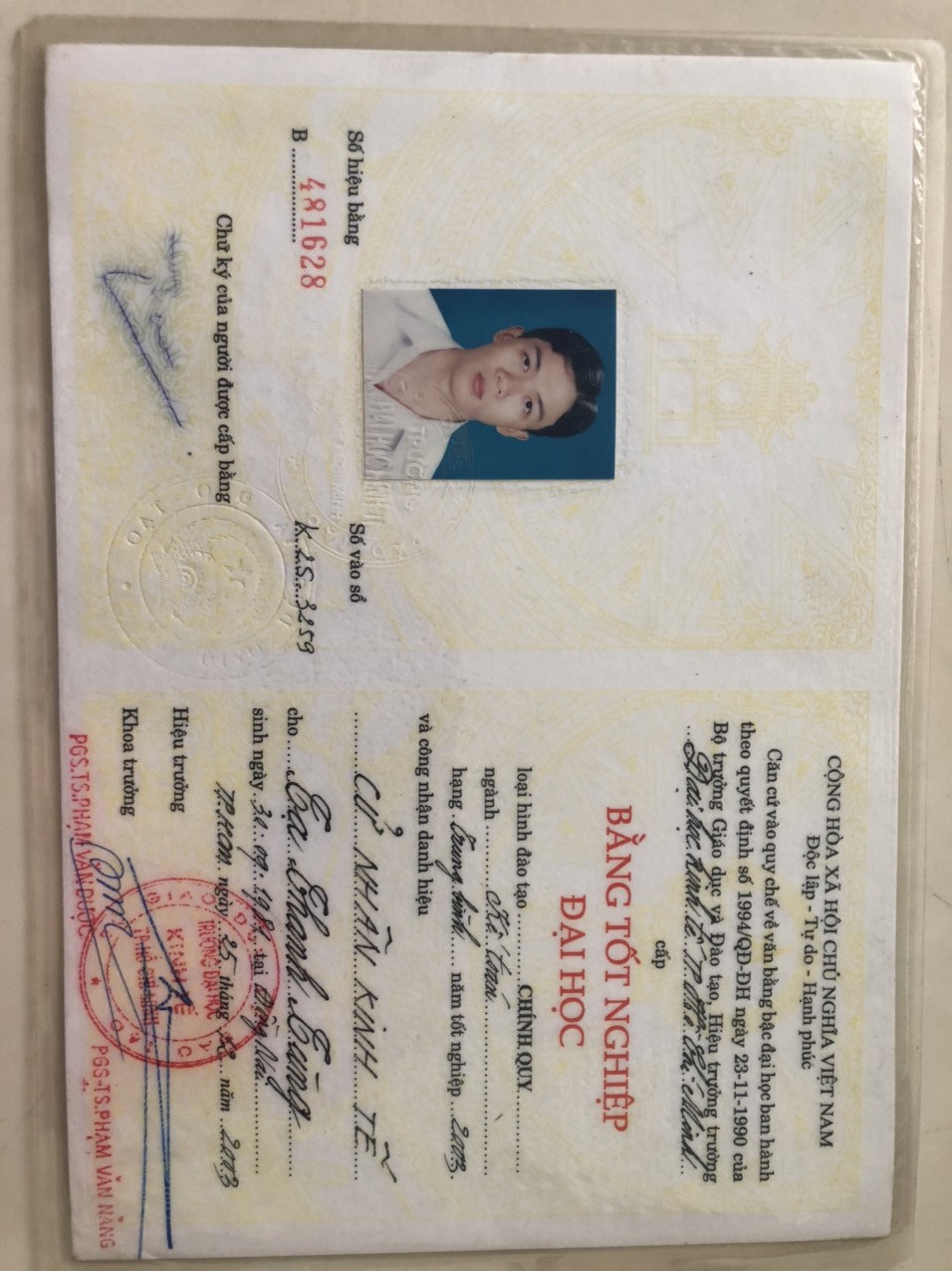

Trình độ học vấn chuyên môn

University of Economics Ho Chi Minh City

Bachelor degree in Accounting and Auditing - Đại học

1999 → 2003

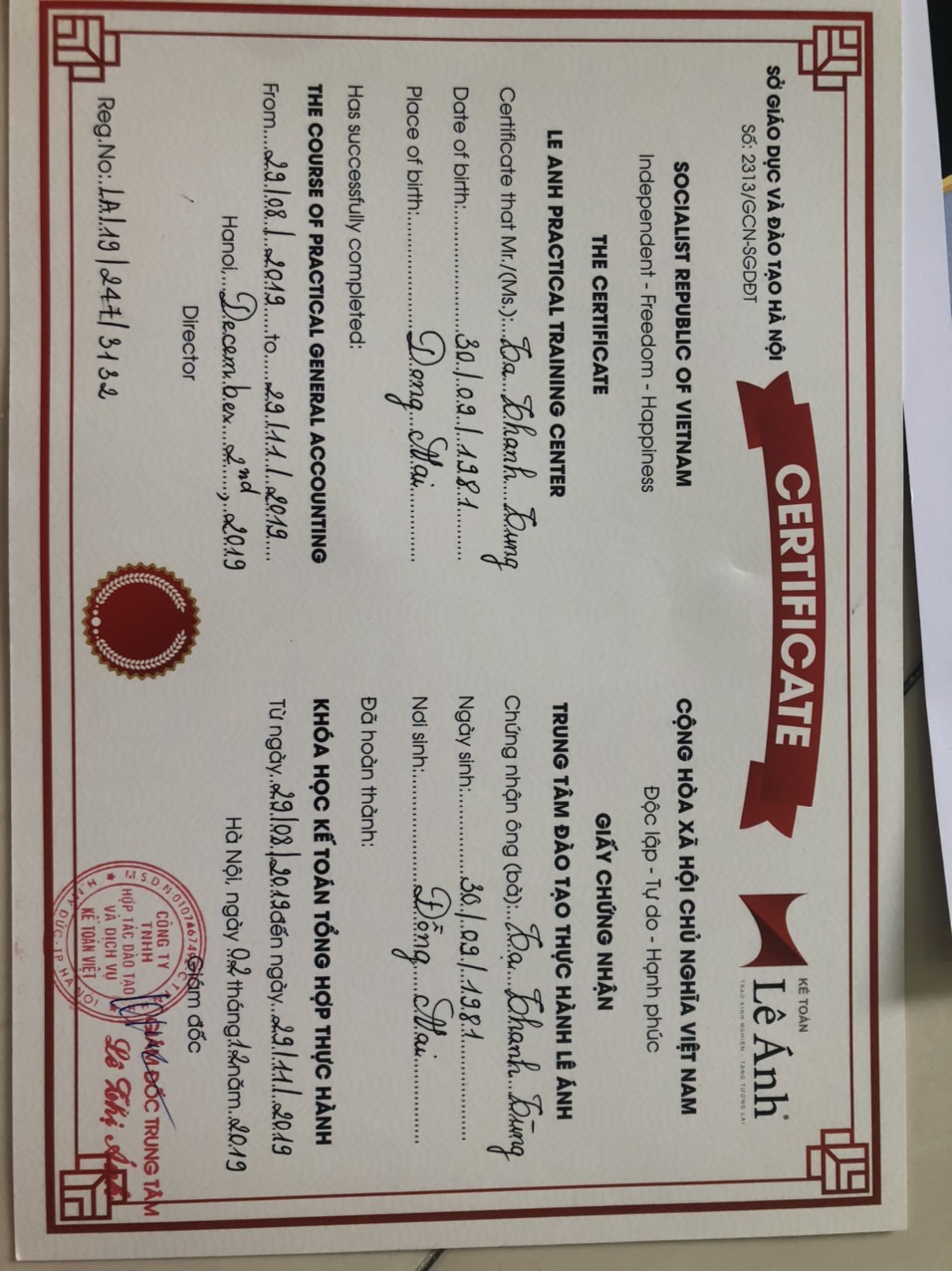

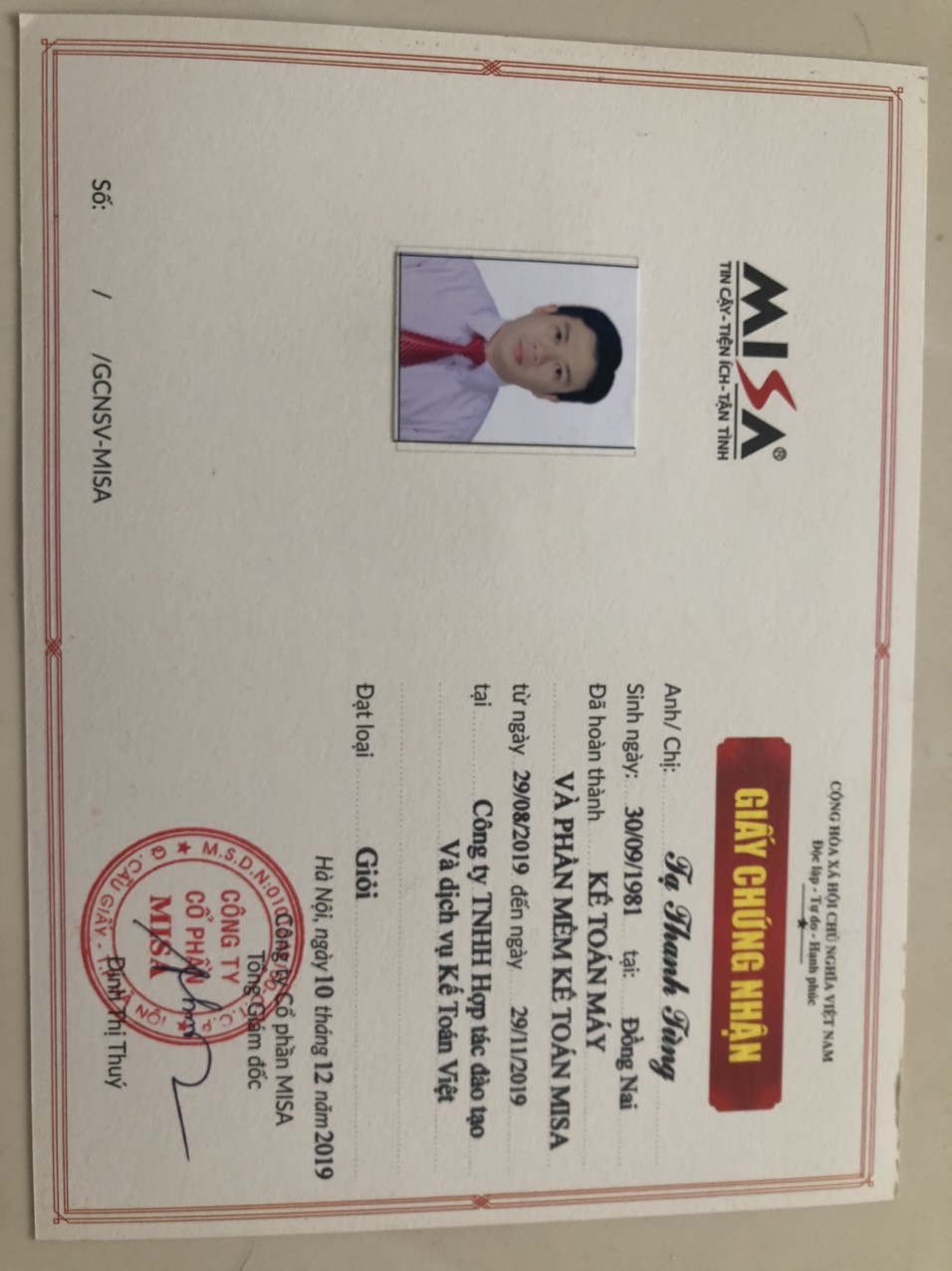

I graduated from University of Economics Ho Chi Minh City with Bachelor degree in Accounting and Auditing. After Graduation, I worked as an accountant and had some additional certifications such as: Certificate of Chief Accountant, Practical accounting software, Practical General accounting, Microsoft office. And now, I am studying for certificate in international financial Reporting (IFRS)

Kĩ năng

| Word/Excel/PowerPoint | |

| accounting software and ERP: SAP HANA ERP, MISA, FAST and BRAVO | |

| Good at English for accounting and finance. I often use English in meetings and work with foreign colleagues and partners in the F&B industry before |

Kinh nghiệm làm việc

Deputy Manager of Accounting Department tại Civil Engineering Construction Corporation No.1 – JSC

8/2005 → 11/2018 (13 năm 3 tháng)

HCMC

Business fields: Building, constructing transport infrastructure Position: General Accountant, Deputy Manager of Accounting Department, Chief accountant of Co Chien Bridge JSC (Subsidiary of Cienco1) Civil Engineering construction corporation No.1 is a professional constructor specializing in constructing transport infrastructure projects with its revenue reaching over VND one trillion per year. The company is both BOT project investor and constructor. I worked as Deputy Manager of Accounting Department here and also was responsible extra position as Chief accountant of its subsidiary which is Co Chien Bridge Joint Stock Company Main duties: Key tasks and several major accounting transactions: - Managing and oversee the daily operations of the accounting department. - Supervise 05 accountants to complete works - Checking the balance between detailed and general accounting data - Preparing all Financial Reports including P&L report, balance sheet, Cash Flow, Notes to Financial Statement - Preparing and checking all kinds of tax reports and tax payment including VAT (Form: 01/GTGT), VAT for investment project (02/GTGT), PIT, FCT (WHT) - Performing tax refund for investment project: VAT declaration for investment (Form 02/GTGT, list table of invoices for purchased goods and services (Form 01-2/GTGT), Request for tax refund (Form 01/ĐNHT) - Maintaining and updating the company accounting system: FAST accounting software - Performing the tax finalization with the Ho Chi Minh City Tax Department. Explain data and supply dossiers and figures to tax offices, audit or inspection units - Coordinating and completing annual audits (Deloitte Viet Nam, A&C, etc.) - Updating and training accounting works, new accounting Standards, Tax Law, Accounting Law and relevant regulations to the staff - Dealing with the bank in relation with banking, financing activities, bank loans capital - Using English: participating to Support Board of Director in the meetings, negotiating contracts with international partners, foreign constructors such as: GS E&C, Hyundai constructors (Korean), Sumitomo (Japan), Hall Brother International Construction (U.S)

Chief accountant tại Vise Hospitality Co., Ltd

11/2018 → 6/2021 (2 năm 7 tháng)

Ruby Tower, District 1, Ho Chi Minh City

Vise Hospitality Co., Ltd is a famous company specializing in the Food and Beverage industry with its revenue reached 15 million USD per year. Its Bar is ranked on top 100 in the world. The founder & operator of VISE Hospitality is the entrepreneur from the USA. I quitted my job at Vise Hospitality Company due to the covid-19 epidemic outbreak. All of our outlets were forced to close at that time and the F&B industry has been seriously impacted financially and operationally Main duties: - Maintain and improve the accounting system of company with BRAVO accounting software: working with IT for accounting functions. Coordinate with the other departments: HR, marketing, sale, finance department, purchasing department, project department, cashier department, warehouse department to establish effectively accounting system - Supervise, instruct and assist 09 accountants to complete the work and report to CFO and COO - Check and approve all accounting document: contracts, invoices, payments, etc. - Perform revenue and expenditure, banking transactions. - Check the entries on incomes, expenses, fixed assets, payable, receivable, and related others which were posted by accountants into Bravo software: Review daily of transactions on the general ledger, it will tell us the entire financial and accounting activities of the company - Check inventories reports (Monthly, quarterly, yearly). Recording inventories in according with method: regular declaration, cost of inventories are determined in according with method: weighted average.. At the end of month, coordinating with warehouse department to count physical inventories. Reconciling inventory report vs sub-ledger (152): main food, fuel (Gas, electricity, water), kinds of spice, subsidiary materials; (156) Beverage, alcohol, beer, tobacco, etc. (153) tool and supplies - Check, calculate and prepare summary and detail tables: tools allocation, increase or decrease in fixed assets (Historical cost, depreciation, allocation, accumulated depreciation, residual value). At Vise, applying depreciation method: straight-line, Estimating useful life under circular No 45/2013 - Calculate the cost of products (dishes, cakes, and drinks): Entry and check all transactions related to labor cost, materials cost and overhead manufacturing cost in software. Collect labor cost, materials cost, overhead manufacturing cost for costing. Check unfinished goods and Finished goods at the end of month, Check entries input-output-inventory Materials and Finished goods. Work with head Chef to check Norm of products. Complete costing monthly and compare with Norm. Accountants only need to enter the number of finished products into the Bravo software, Bravo will automatically calculate, release raw materials, calculate product costs based on previously established norms. - At the end of month: Checking for salary, PIT, social insurance which made by HR/ Allocated prepaid expense/ Checking and calculating depreciation, Accrual, cost of inventories, cost of products/ Revalue the balance of foreign currencies at the reporting date. Preparing trial balance sheet (incurred balance sheet of all accounts), reconciling opening balance, incur and closing balance between trial balance sheet with balance in sub-ledger and other original documents such as cash fund book, bank statement, invoices, tax declaration reports, letter of receivables and payables confirmation, etc. Any differences should be investigated and perform adjustment if necessary. Offsetting receivable, payable balance of the same entity, offsetting input VAT against output VAT to determine VAT payable amount. - At the end of month: Making the monthly, quarterly and yearly financial reports/ Making monthly, quarterly and yearly declaration and payment of VAT, PIT, FCT and CIT. - Check and double check monthly, quarterly and yearly financial reports including trial balance, balance sheet, P&L report, cash flow, notes to Financial statement - Ensure internal and external reports timely, accurately and comply with Viet Nam Law - Implement, complete, and ensure all Tax reports with District 1 Tax Department. Review tax declaration, including VAT, PIT, CIT, FCT and other Taxes (import and export duty, special consumption tax, etc.) - Prepare and control Financial Budget Plan, Forecast Budget: Support and Coordinate with other Departments for Prepare Budget Plan weekly, monthly and yearly. Forecast Revenue, operating expenses, costing, Profit or Loss, cash flow - Deal with the bank: Credit card transaction on POS, financing activities, bank loans capital - Be responsible for explaining to BOD and Foreign Shareholders (From US, Hong Kong) in English about daily or monthly tasks related to accounting works as well as current accounting policies in Viet Nam - Coordinate and complete annual audited reports with auditors (Deloitte Viet Nam) - Others daily and monthly duties requested by CFO and COO

Chief accountant tại DAI PHAT DAT INVESTMENT AND SERVICE TRADING COMPANY

6/2021 → 4/2023 (1 năm 10 tháng)

HCMC

In June 2021, I quitted my job at Vise Hospitality Company due to the covid-19 epidemic outbreak. All of our outlets were forced to close. I decided to start my own business and contributed my capital into DAI PHAT DAT INVESTMENT AND SERVICE TRADING COMPANY with some my friends . I worked as Chief Accountant here. During this time, I also learned and practiced about SAP HANA ERP and IFRS to improve my skills. Some main duties included: - Manage and oversee the daily operations of the accounting department. - Set up the accounting system with MISA accounting software - Perform revenue and expenditure, banking transactions. - Manage invoices, contracts, and accounting documents in accordance with the law. - Check and confirm A/R, A/P and monthly VAT invoices. - Making the entries on incomes, expenses, fixed assets, payable, receivable, and related others into Misa accounting software - Making a monthly payroll - Making Finalization of CIT - Making a quarterly and yearly declaration and payment of VAT, PIT and CIT - Making the yearly financial report.

Mong muốn về công việc

Giải thưởng

Thông tin tham khảo

Ms Vu Tran Tuyet Nhung - Chief Accountant

Civil Engineering Construction Corporation No.1 – Joint Stock Company

nhungvutt@gmail.com - 0989009239

Mr Ngo Bang - CEO

DAI PHAT DAT INVESTMENT AND SERVICE TRADING COMPANY

Bangngo1981@gmail.com - 0977100066

Mr Le Anh Tuan - Assistant to Chief Financial Officer

Vise Hospitality Co.,Ltd

tuan.le@visehospitality.com - 0785120492

Kho tài liệu

Kho tài liệu  Chuyên trang đào tạo

Chuyên trang đào tạo

Việc làm thêm

Việc làm thêm

242 Lượt xem hồ sơ

242 Lượt xem hồ sơ

Google

Google Facebook

Facebook Zalo

Zalo